Brampton 2025 Property Tax Rate. Yes, you read that correctly. The average increase for the residential class for brampton was approximately 26.33%.

If you own a property or parcel of land, you will have to pay property. [2] price data, which includes both resale and.

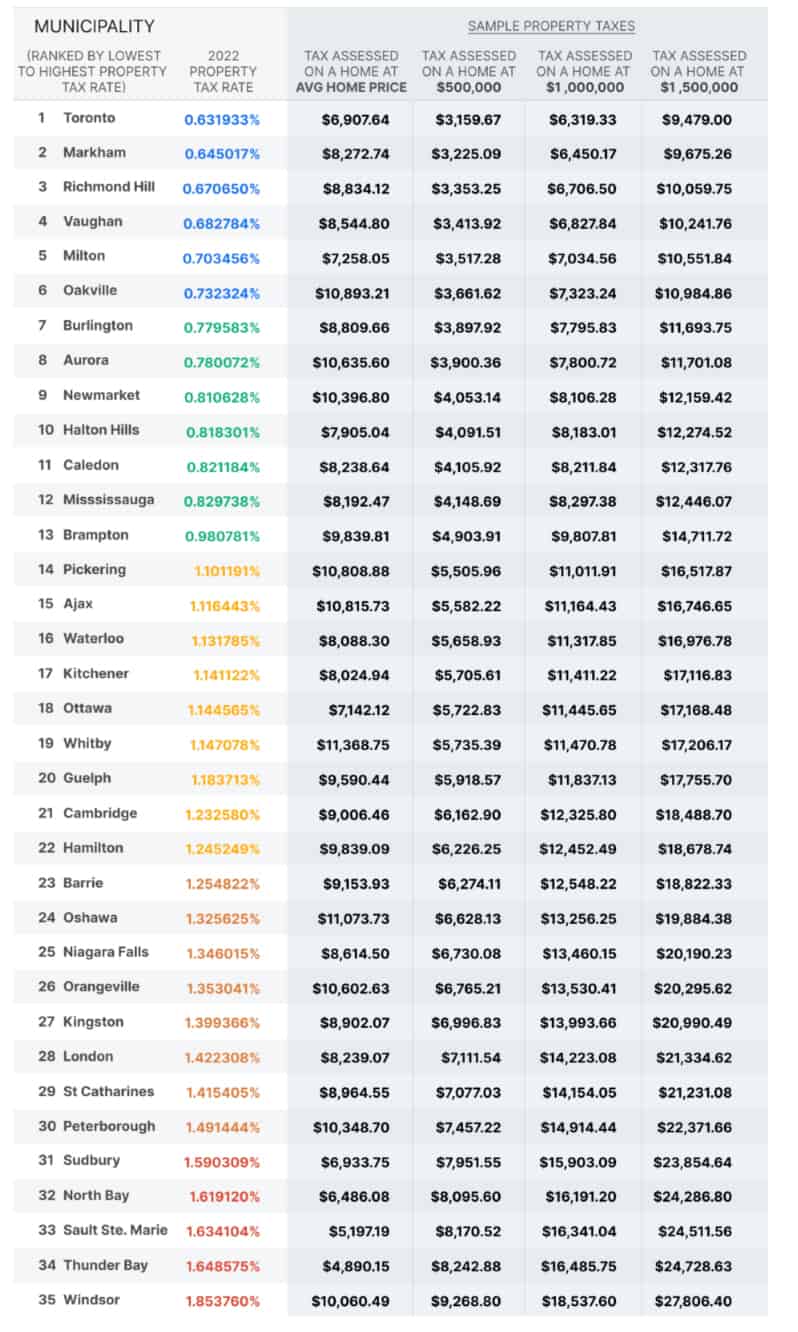

Brampton ranks 13th on list of Ontario property tax rates INsauga, Property tax is a tax based on the assessed value of a property.

How Much Tax Will You Be Paying Brampton in the Future? insauga, Last december, brampton approved its third consecutive zero percent increase in property taxes for residents on the city’s portion of the tax bill, part of a $1.2 billion budget which includes.

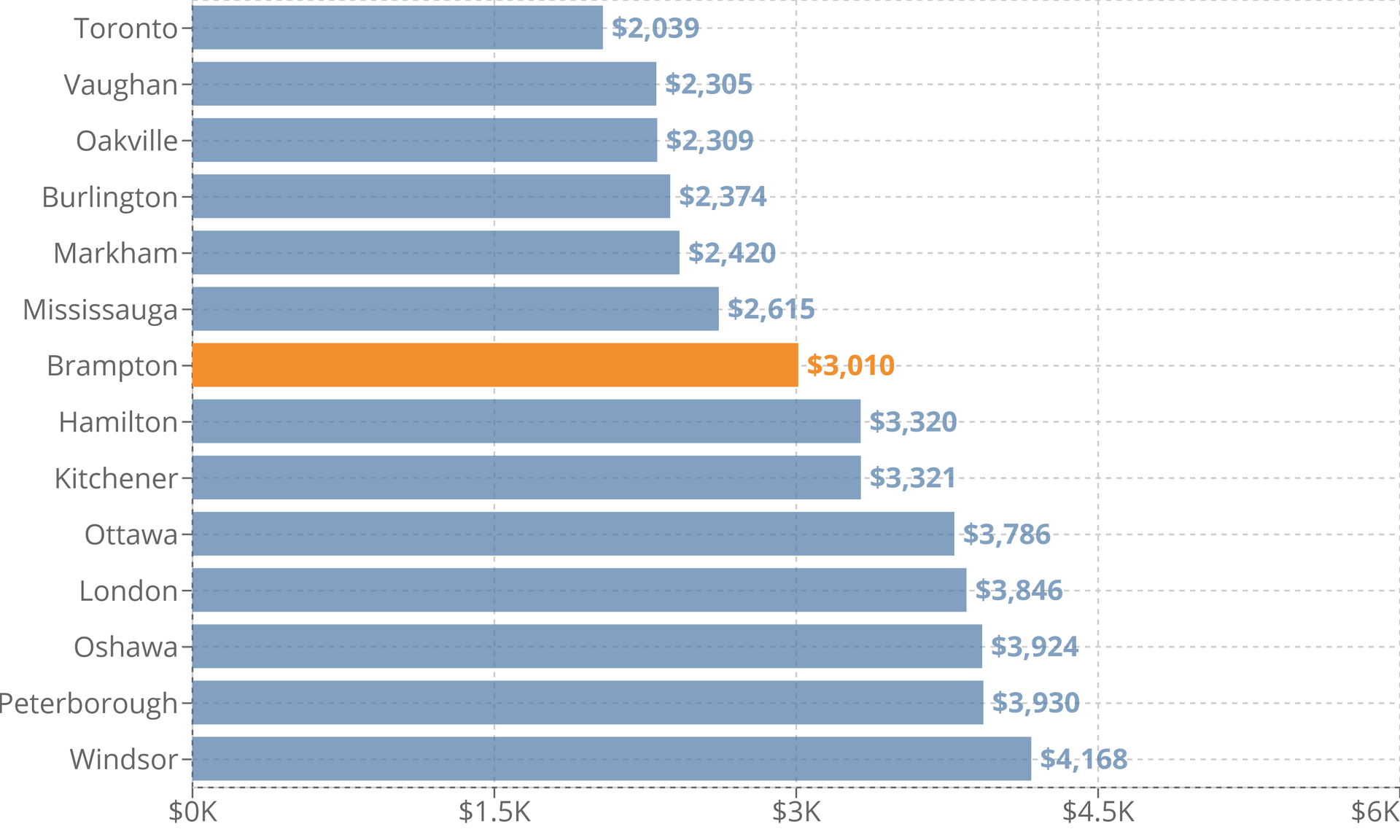

Mississauga and Brampton have higher property taxes than most, Property tax is a tax based on the assessed value of a property.

Brampton Property Tax 2025 Calculator & Rates WOWA.ca, Last december, brampton approved its third consecutive zero percent increase in property taxes for residents on the city’s portion of the tax bill, part of a $1.2 billion budget which includes.

These States Have the Highest Property Tax Rates TheStreet, Members of city council have often boasted about how property taxes have remained flat in brampton since 2018.

2025 Tax Rates A Comprehensive Overview List of Disney Project 2025, If you own a property or parcel of land, you will have to pay property.

San Antonio Area Tax Rates Providence Title Company of Texas, The proposed $6.2 billion budget.

toronto property tax bill GTA Weekly, The specific property tax rate for a certain year depends on the budget of the municipality and its total assessment base (their tax base).

Average Brampton real estate price surges 250K in 13 months to over 1M, Homeowners in brampton will see their first property tax increase in years now that the city has approved the 2025 budget.