California State Withholding Tax Rate 2025. Your california tax rate and tax bracket depend on your taxable income and filing status. The below brackets or rates are for tax year 2025.

We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. However, most financial firms will automatically withhold 10 percent of.

Tax Rate In California 2025 Blisse Zorana, Calculate your tax using our calculator or look it up in a table of rates. In addition to how much you pay employees, payroll management is also about how much you withhold from their wages.

Tax Brackets 2025 California Tax Credits Ivie Rhodie, The federal supplemental withholding tax is 22%. Instead, you use the supplemental.

2025 State Tax Rates and Brackets Tax Foundation, Massachusetts has a flat tax rate of 5%. The undersigned certify that, as of june 13, 2025, the internet website of the california department of tax and fee administration is designed, developed, and.

Tax rates for the 2025 year of assessment Just One Lap, 2025 state tax rates and brackets tax foundation, 2025 personal amounts (1) 2025 tax rate: We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding.

10+ 2025 California Tax Brackets References 2025 BGH, Form de 4, employee’s withholding. The latest state tax rates for 2025/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states.

California State Withholding Form 2025, In california, a law signed in 2025 takes effect on january 1, 2025, which eliminates the taxable wage limit on employee wages subject to california’s state. ( 2019 2018 2017 2016 2015 ) tax rate used in calculating california state tax for year 2025.

Irs New Tax Brackets 2025 Elene Hedvige, The low income exemption amount for single and. California has nine state income tax.

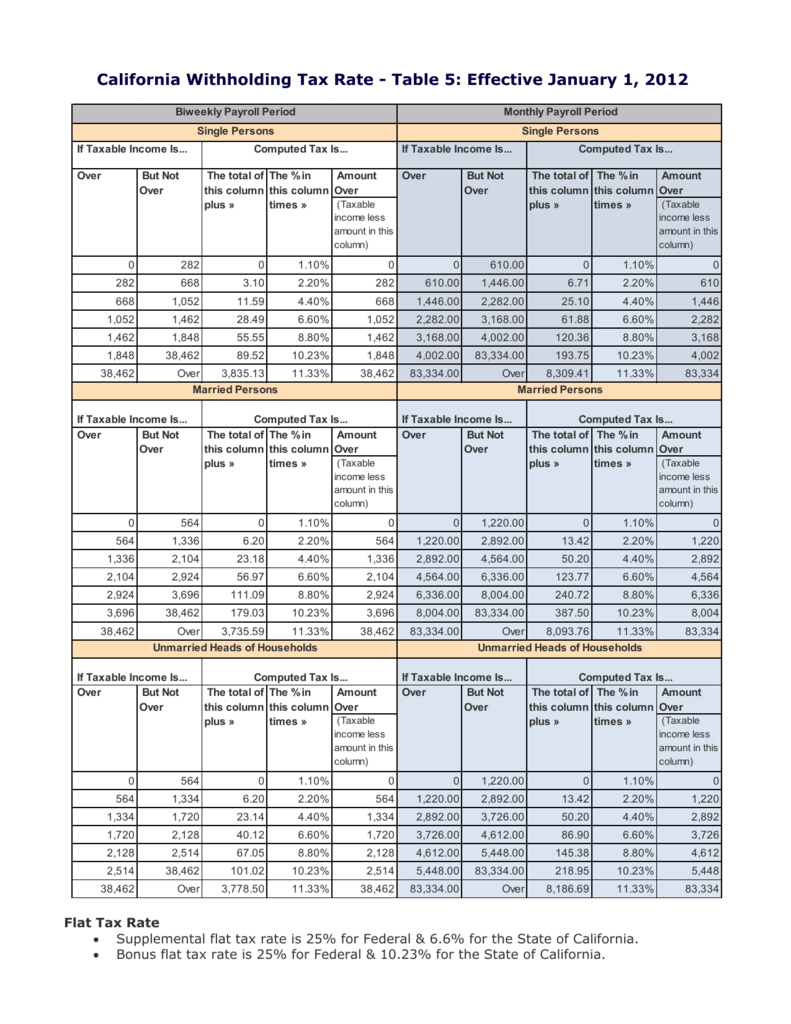

Withholding Tax Table, Mass state tax rate 2025. However, most financial firms will automatically withhold 10 percent of.

Withholding Calculator, California’s withholding methods will be adjusted for 2025. Californians pay the highest marginal state income tax rate in the country — 13.3%, according to tax foundation data.

Tax Rates 2025 To 2025 2025 Printable Calendar, The tax hike will pay for an increase in benefits under california’s state disability insurance and paid family leave programs starting jan. Wage withholding is the prepayment of income tax.