Inheritance Tax Virginia 2025. As a result, you won’t owe virginia inheritance taxes. You need to pay transfer tax, property tax, and capital gains tax to sell an inherited property.

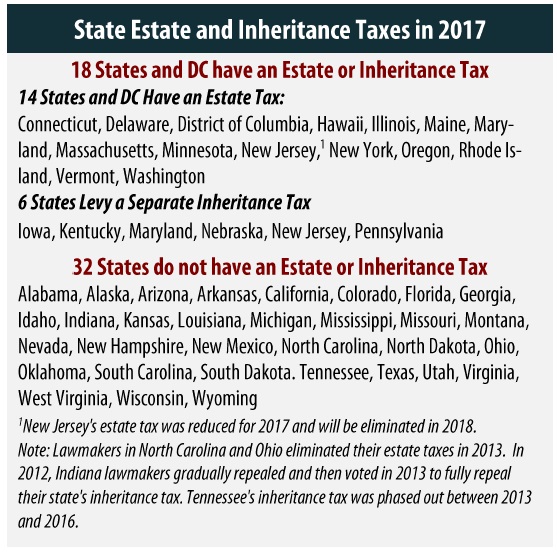

Below is a summary of the states that as of 2025 still impose estate, gift, or inheritance tax: Today’s taxa tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general.

Estate and Inheritance Taxes Urban Institute, Prior to july 1, 2007, virginia had an estate tax that was equal to the federal credit for state death taxes. Virginia does not have an inheritance tax system, but other local jurisdictions do.

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, Since virginia is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero). But assets left in a will usually must go through probate.

what is the inheritance tax rate in virginia Tesha Hefner, Receiving an inheritance often prompts questions about tax liabilities. If you make $70,000 a year living in wisconsin you will be taxed $10,401.

Inheritance Tax on Property Everything You Need To Know, If you make $70,000 a year living in wisconsin you will be taxed $10,401. The tax is assessed at the rate of 10 cents per $100 on estates valued at more than $15,000, including the first $15,000 of assets.

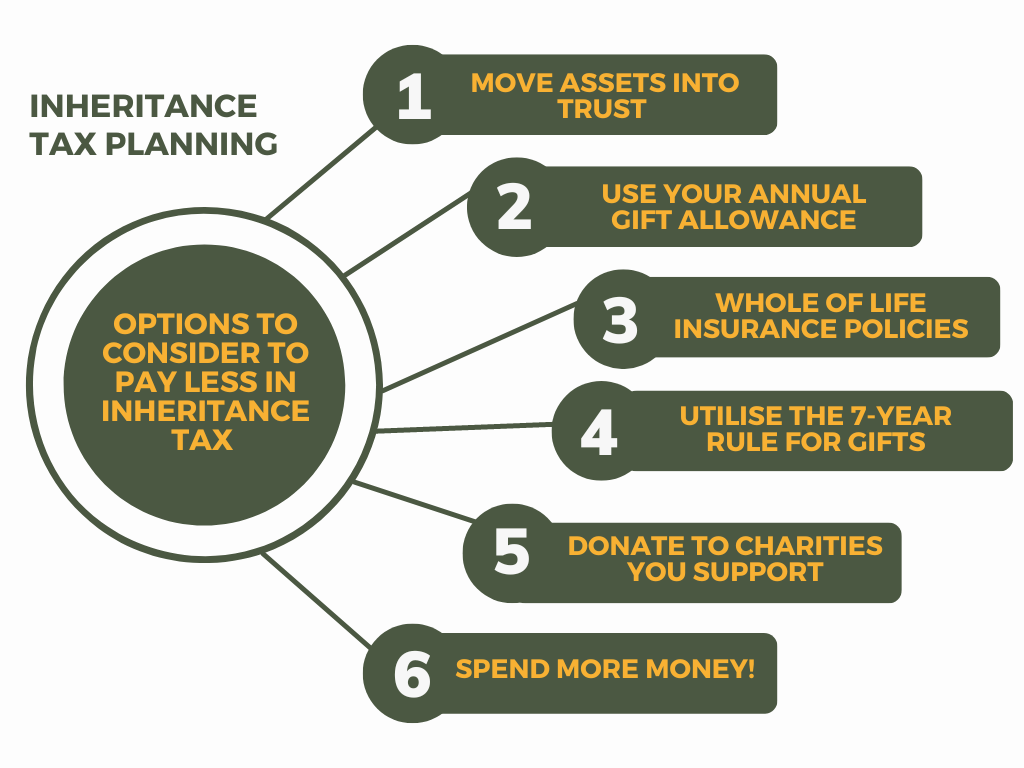

Inheritance Tax Planning Sunny Avenue, Virginia doesn’t have an estate tax or an inheritance tax, but that doesn’t mean that there are no taxes to file when a decedent dies. As a result, you won’t owe virginia inheritance taxes.

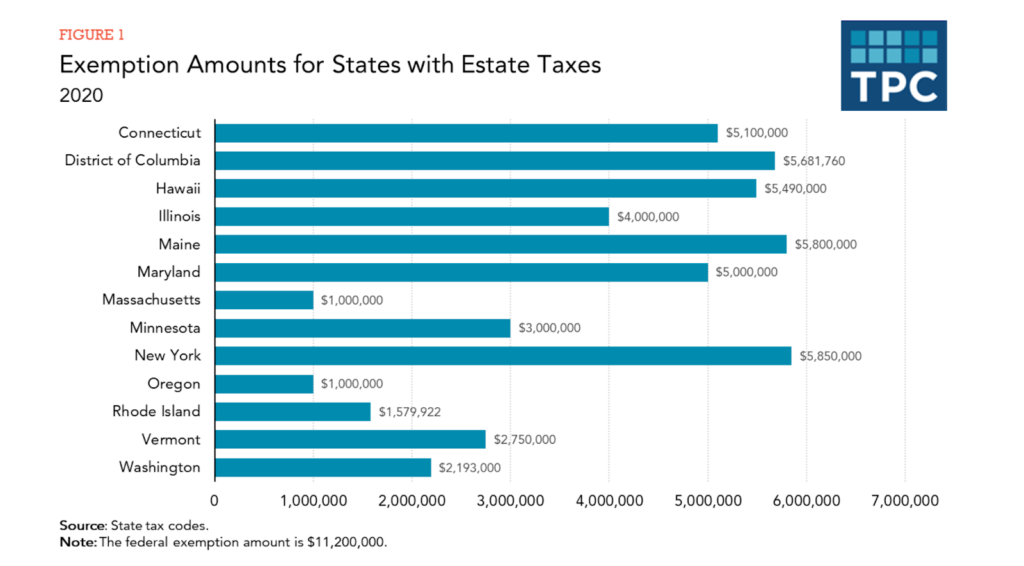

What is an Inheritance Tax, or Estate Tax? Cowdery Tax, The federal estate tax exemption for 2025 is $12.92 million, which means that estates below this threshold won’t be subject to paying taxes at the federal level. [1] ct gift and estate tax is unified, so that lifetime gifts deplete.

All You Need to Now About Inheritance Taxes at Federal and State Level, Virginia does not have an inheritance tax system, but other local jurisdictions do. Guide to iowa inheritance tax.

Tax rates for the 2025 year of assessment Just One Lap, What is the federal estate tax? Virginia doesn’t have an estate tax or an inheritance tax, but that doesn’t mean that there are no taxes to file when a decedent dies.

Inheritance tax written on a paper. Financial concept. Longmores, Is there an inheritance tax in virginia? Taxes to sell an inherited property:

State Estate and Inheritance Taxes ITEP, Below is a summary of the states that as of 2025 still impose estate, gift, or inheritance tax: Posted by aubrey carew sizer | aug 01, 2025.