Max 401k In 2025. Employees can contribute up to $23,000 to their 401 (k) plan for 2025 vs. For employer sponsored plans including 401 (k),.

What is maximum 401k contribution for 2025. Employees can contribute up to $23,000 to their 401 (k) plan for 2025 vs.

The Maximum 401k Contribution Limit Financial Samurai, More than this year, if one firm’s forecast is any. In 2025, you can put away as much as $22,500 into a 401 (k) retirement.

401k Calculator Calculators For All Mobile Friendly, If you contribute, say, $23,000 toward your 401 (k) in 2025 and your employer adds $5,000, you’re still within the irs limits. This amount is up modestly from 2025, when the individual 401.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, 48 rows every year, the irs sets the maximum 401. The update forecasts a $1,000 boost to this year’s 401 (k) elective deferral limit of $23,000, which would bring the 2025 limit to $24,000.

Max out 401k calculator MarionRocky, Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025. 48 rows every year, the irs sets the maximum 401.

Best Guide to 401k for Business Owners 401k Small Business Owner Tips, Get to know how much you can save in your 401 (k). Max roth 401k contribution 2025 over 55.

The Maximum 401(k) Contribution Limit For 2025, 401k 2025 contribution limit irs over 50. The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to rise by $2,000.

Max Individual 401k Contribution 2025 Lorie Raynell, The table below shows the maximum contributions allowable for most plan types as well as a number of plan thresholds. The ira catch‑up contribution limit for individuals.

401(k) Contribution Limits in 2025 Meld Financial, Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025. Those who are age 60, 61, 62, or 63 will soon be able to set aside.

Self Employed? Best Retirement Plans SoloK, SEP/SIMPLE, IRA, Those who are age 60, 61, 62, or 63 will soon be able to set aside. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025.

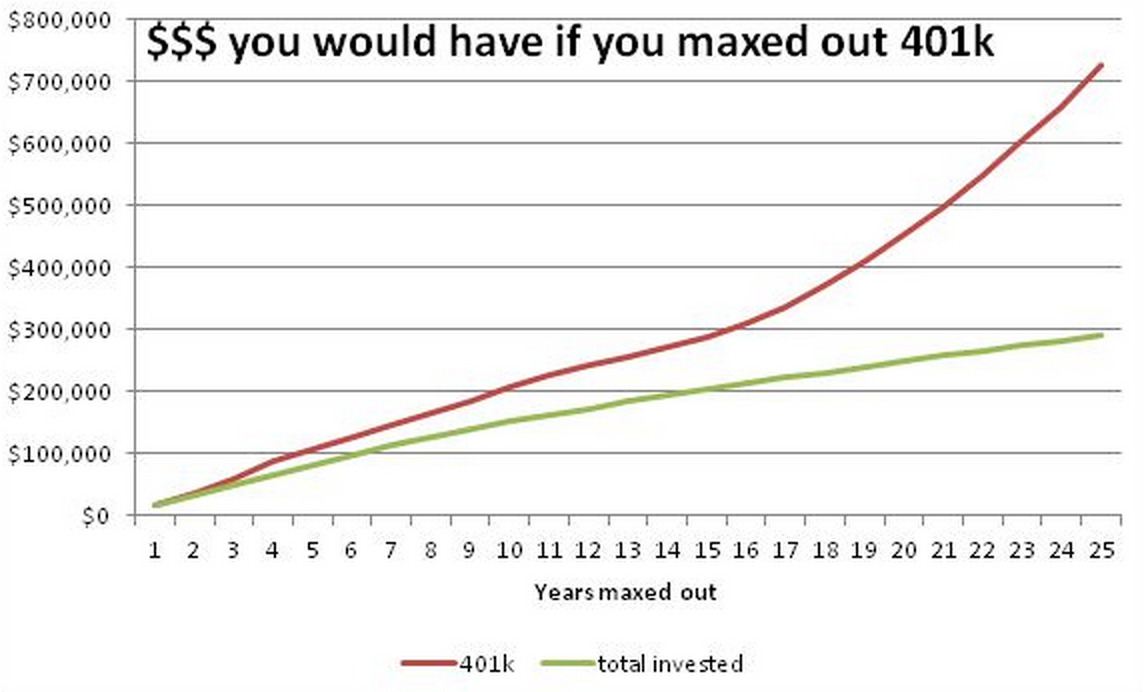

401k Contribution 2025 Max Karin Marlene, How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025? Extend the time frame out to 30 years instead of 20, and the balance grows to $651,306.

If you contribute, say, $23,000 toward your 401 (k) in 2025 and your employer adds $5,000, you’re still within the irs limits.